Overview of Operating Environment

The period under review experienced relatively stable environmental conditions compared with the corresponding period last year. Inflation and exchange rate pressures were somewhat muted due to the tight macroeconomic management policies adopted by the authorities. ZWG and US dollar quarterly inflation rates were 10.9% and 14.9%, respectively. Further, the interbank exchange rate remained relatively stable while the alternative market premium narrowed to about 30% from approximately 36% in Q1 2024. Tight monetary conditions resulted in liquidity challenges. Against this, there has been extensive use of the US dollar. Available economic reports by leading financial institutions have projected a bullish economic outlook for Zimbabwe this year. This is expected to have a significant knock-on effect on the income accruing to your company during the year.

Economic policy uncertainty, as well as geopolitical and trade tensions, continue to stall global economic recovery. Protectionist policies are expected to disrupt supply chains, distort trade flows, and fuel inflationary pressures. These developments will negatively affect the cost of doing business through imported inflation and supply chain challenges (delays and cost of shipments). Management will closely monitor these developments to reduce their impact on maintenance, property refurbishments, and new developments.

Property Market Overview

Zimbabwe’s property market is transforming. Businesses are moving from traditional Central Business District (CBD) offices and retail spaces to suburban hubs. The infrastructure upgrades and shifting business preferences have primarily been responsible for this shift. Major arterial routes are now focal points for commercial activity, with rising demand for converted residential-office spaces and mixed-use developments in high-growth areas such as Borrowdale, Mount Pleasant, and Vainona. Recent projects like the Greenwood Park Mixed-Use Precinct and new warehouse clusters in Msasa and Graniteside reflect this trend. The market has also seen the construction of Stanbic Bank and Ecobank’s head offices in Borrowdale.

Nonetheless, adaptive reuse opportunities exist in the CBD. Property owners and investors are converting vacant offices to residential or boutique retail to align with urban renewal initiatives. The CBD’s reinvention could unlock new value in the coming years. Further, investment in the road network, utility upgrades, and supporting infrastructure remains key to the sustainable development of Zimbabwe’s property market.

Rentals are denominated in both the US dollar and ZWG. However, US dollar leases are more pronounced for prime assets, while the local currency is widely used for mid-market property rentals.

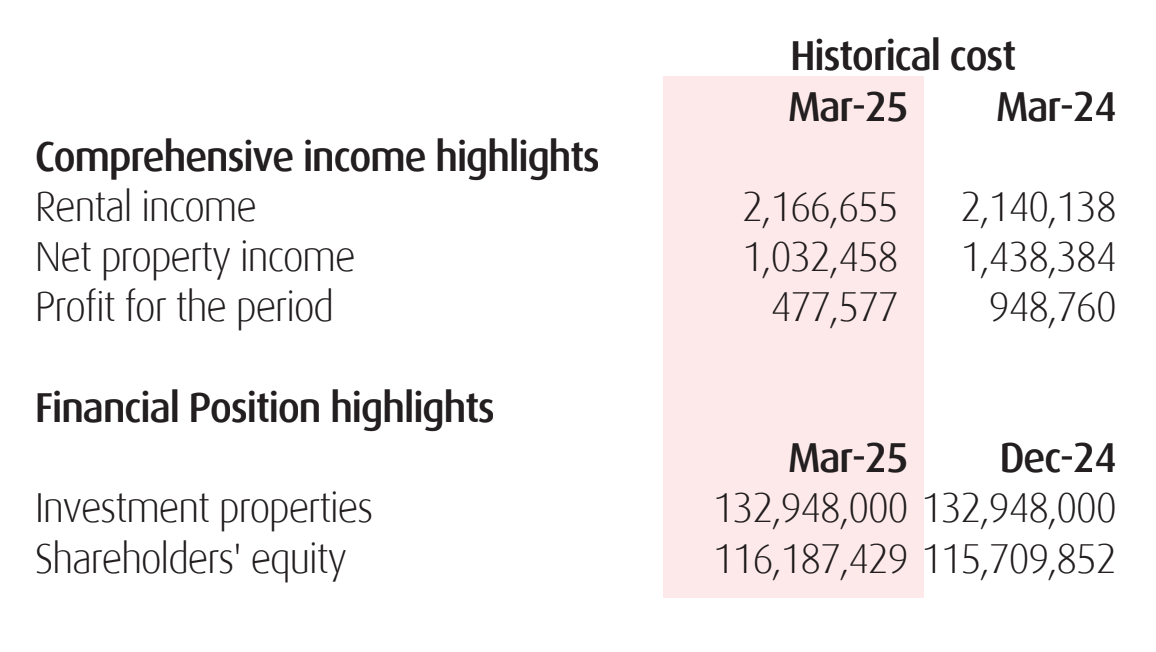

USD Financial Performance Highlights (USD)

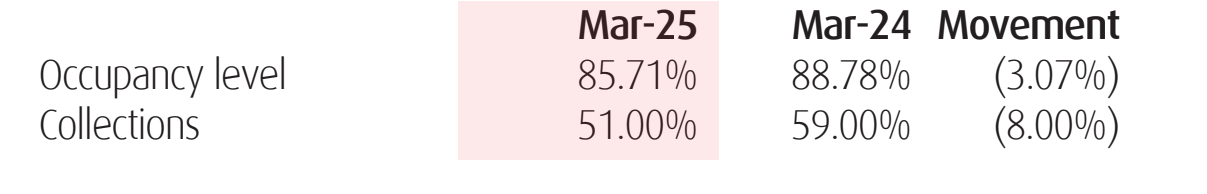

Key Performance Indicator Highlights

Rental income for the quarter increased by 1.2% compared to the same period last year, driven by rent reviews. Net property income decreased by 28% following the completion of running projects, which resulted in reduced project management fees. Investment properties were valued at USD 132.948 million as of 31 March 2025.

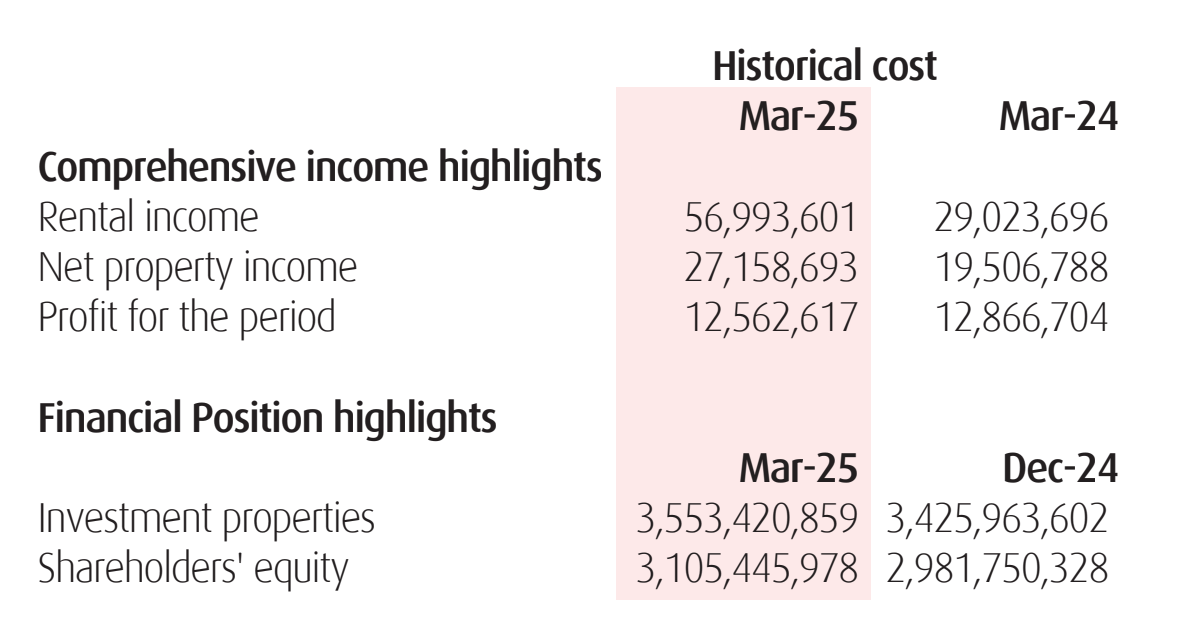

ZWG Financial Performance Highlights (ZWG)

Rental income for the quarter was ZWG 56.9 million (FY 2024: ZWG 29 million). Net property income grew to ZWG27.2 million from ZWG19.5 million in the prior year which was driven by the movement in the interbank exchange rate for the USD to ZWG which closed off Q1 in 2025 at ZWG 26.76 versus ZWG 13.56 in Q1 in 2024. As of 31 March 2025, investment properties were translated to ZWG 3.553 billion (FY 2024: ZWG 3.426 billion).

Developments

The business will implement pipeline development projects on its existing land bank to expand and diversify its portfolio.

Sustainability

The Group is accelerating its green sustainability initiatives across key properties as part of its commitment to environmental stewardship and operational excellence. We will prioritise eco-conscious building practices, waste management innovation, and improving recycling infrastructure. These efforts align with global Environmental Social and Governance (ESG) standards and reinforce our mission to deliver future-ready, sustainable spaces that benefit our tenants and communities.

Dividend

At a meeting held on 9 May 2025, the Board of Directors recommended that no dividend be paid for the first quarter of 2025 and that the available cash be directed to the expansion projects.

Outlook

Zimbabwe’s property market presents growth opportunities in affordable housing, commercial real estate, and diaspora-driven investments. Management will continue to monitor market developments and introduce appropriate products.

By order of the Board

Mrs Dulcie Kandwe

Company Secretary